city of richmond property tax 2021

A tax increase will be an extra burden on homeowners as well as on small business and renters whose landlords will pass on the added taxes to them in future rent increases. 295 with a minimum of 100.

Edmonton Council Approves 1 9 Property Tax Hike For 2022 Cbc News

What is considered real property.

. As June 5 falls on a Sunday all payments postmarked on or before June 6 will not be subject to penalties and interest for late payment. The ordinance that was introduced at the Feb. 3 Road Richmond BC V6Y 2C1.

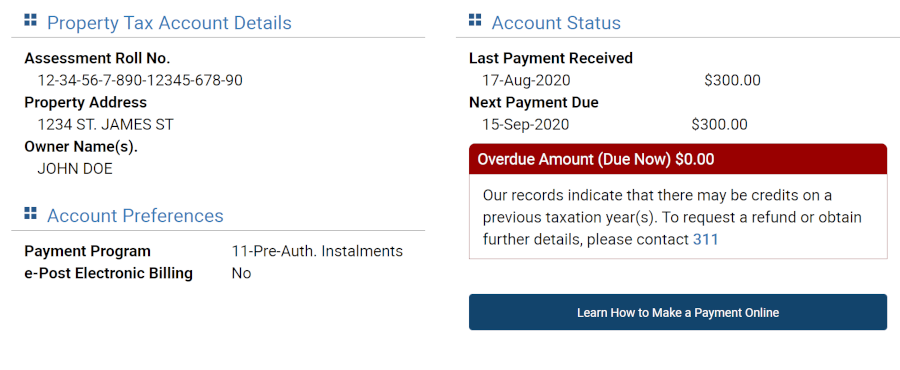

Visit our credit card payment page to access this option. Taxpayers can either pay online by visiting RVAgov or mail their payments. City of Richmond Tax Department 6911 No.

Richmond continues to be one of the cities with the lowest residential property tax rate in the Lower Mainland. With this option the company that processes the payment will collect a 25 service fee. Weeks after Wayne County considered and then turned down a raise to part of its property tax rate the city of Richmond is thinking about a hike of its own.

Use the search tab to add properties to your selection list. The City of Richmonds 2020 residential rate. Property tax revenues are the largest component of.

The City Hall cashier area has been reopened for tax and utility payments only. Contact the City of Richmond Tax Department at 604-276-4145 for further information about PAWS. 3 city council meeting takes the current rate of 00414 for every 100 of assessed valuation and moves it to 005.

3 Road Richmond British Columbia V6Y 2C1 Hours. Richmond property owners are reminded that property taxes are due on Friday July 2 2021. Richmond residents will have until July 4 to pay their property taxes without penalty.

For tax year 20222023 92000 or less. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Any unpaid taxes after this date will receive a second penalty.

Tax notices were mailed out at the end of May but if you have not received your statement please call the City Tax department immediately at 604-276-4145. Tax Ratio for 2022. This sum is raised by applying the citys property tax rate of 12 to the assessed value of the structures which constitute about 74 of total property value in.

Within Richmond city limits a total of 3223 parcels constituting more than 8500 acres valued at some 74 billion are identified as tax exempt meaning they pay no property taxes at all. The budget calls for lowering the property tax rate from 0687772 to 068. What is the real estate tax rate for 2021.

3 Road Richmond British Columbia V6Y 2C1 Hours. Personal property tax bills have been mailed are available online and currently are due June 5 2022. To view previous years Millage Rates for the City of Richmond please click here.

Do not send cash in the mail. It may make sense to get help from one of the best property tax attorneys in Richmond County VA. 604-276-4000 City of Richmond.

815 am to 500 pm Monday to Friday. Lets find out using the 2021 tax rolls. To learn more about credit card payments please view our Payment Options page.

While I appreciate sound fiscal management 2021 is not the time to burden the residents of Richmond with a tax increase. The second due date for an outstanding tax balance is September 2 2022. Given the Citys tax rate of 120 per 100 of assessed value thats 886 million in foregone tax revenue in 2020 alone.

604-276-4000 City of Richmond. What is the due date of real estate taxes in the City of Richmond. Property Taxes are due once a year in Richmond on the first business day of July.

Tax bills are mailed out on July 1st and December 1st and are due on September 30th and February 28th. We need to give people time to get back on their feet. Business hours are Monday to Friday 815 am.

The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Richmond Hill now accepts credit card payments for property taxes. Real Estate and Personal Property Taxes Online Payment.

Richmond City collects on average 105 of a propertys assessed fair market value as property tax. The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Property Taxes are due once a year in Richmond on the first business day of July.

Electronic Check ACHEFT 095. Home Our Services Property Tax Billings. Tax Ratio for 2021.

Richmond City Hall. Property Pre-Authorized Withdrawal Changes or Cancellations. The real estate tax rate is 120 per 100 of the properties assessed value.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. The second due date for an outstanding tax balance is. Parking Violations Online Payment.

Real estate taxes are due on January 14th and June 14th each year. For a homeowner with a property. Admissions Lodging and Meals Taxes Online Payment.

Interest is assessed as of January 1 st at a rate of 10 per year. 2021 Richmond Millage Rates. 815 am to 500 pm Monday to Friday.

Mon day July 4 2022.

Paying Your Property Tax City Of Terrace

Toronto Property Tax 2021 Calculator Rates Wowa Ca

Toronto Property Taxes Explained Canadian Real Estate Wealth

Toronto Property Taxes Explained Canadian Real Estate Wealth

Ontario Property Tax Rates Calculator Wowa Ca

:format(webp)/https://www.thestar.com/content/dam/thestar/business/personal_finance/2010/09/07/property_tax_10_things_you_need_to_know/the_take_on_the_taxhike.jpeg)

Property Tax 10 Things You Need To Know The Star

Ontario Cities With The Highest Lowest Property Tax Rates October 2022 Nesto Ca

Mississauga Boasts 11th Lowest Property Tax Rate In Ontario Insauga

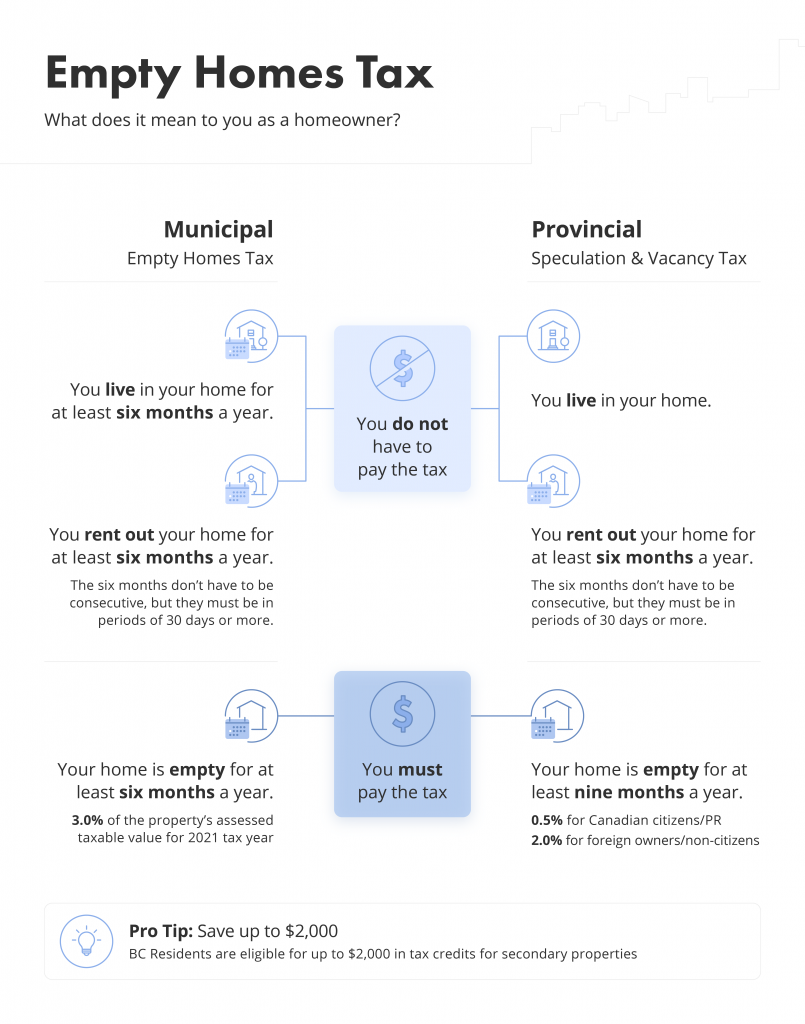

Updated For 2022 Homeowner S Guide To Bc Taxes Property Tax Empty Homes Tax More Liv Rent Blog

Photo Images Of Richmond Virginia Richmond Virginia Richmond Va Places To Visit Richmond

All The Taxes You Ll Pay To New York When Buying A Home

Richmond Property Tax 2021 Calculator Rates Wowa Ca

Average Residential Tax Bill Amount

These 6 Ontario Cities Currently Have The Lowest Property Tax Rates In The Province